Here is a run through of this weeks observations:

The Basic Model

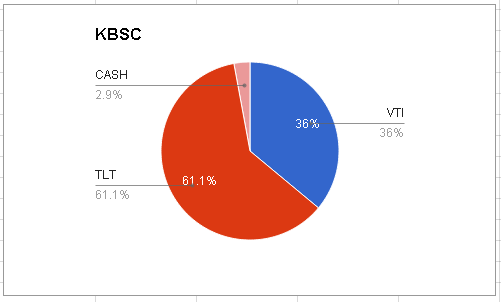

One of my models is a simple allocation program between the total stock market, VTI, and long term government bonds, TLT. These two ETFs are a great pair to follow since they have almost the same average volatility. Thus, they can be compared based on pure relative strength with about equal expectations for each holdings appreciation or depreciation capability.

The current allocation for this program IS NOW Conservative (about <40% stocks). This week saw another shift towards bonds with the stagnation in stocks.

Last week, I said I would be worried about US stocks if my models started to raise cash against US holdings. As you can see, the basic model has begun to do just that. However, this is a basic model for a reason. I trust it in the long term to allocate correctly. Thus, I would like to see a week or two more sustained at these allocations to assume a more bearish outlook for US stocks.

A potential bullish outcome of these numbers is that the October 2014 low also coincided with these sorts of allocations before stocks rallied into the year's end. Thus, it may be time for US stocks to flex some relative strength (not necessarily absolute strength) muscle this coming week. Regardless, US stocks have been weak relative to other assets the past few weeks.

What's up with the POS? Is it stuck?

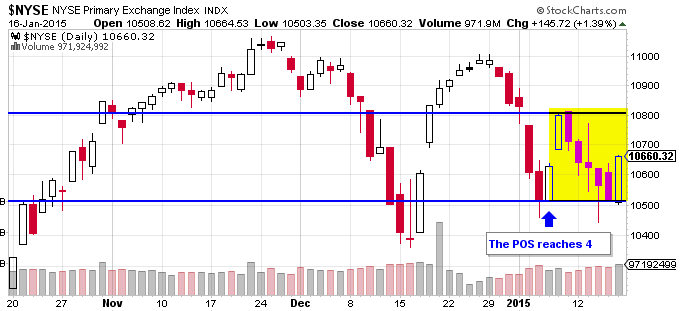

If you have been following my POS market index, you have noticed that it has stayed at 4, caution, for almost two weeks.

I have looked into this and there is actually good reason why my model has not gone full bearish where others like Dr. Wish have their GMIs on a sell. Take a look at the $NYSE for the time the POS has been at a 4:

During the last few days, the stock market has gone sideways, stuck in a horizontal channel. While this is not ideal, it is certainly not a reason to panic. Moreover, the S&P 500 has not pulled back more than 5% from its recent high during the current weakness. Remember, 10% is the marker for a correction.

Thus, the POS is actually doing exactly as I hoped. Let's visit my explanation of the POS scores (under POS Scores Explained) for a "4": 3-4 & Down-tick: Caution, markets are indecisive, do not open any new longs, tighten stops and look to exit. This is exactly what I would want in the back of my mind for current conditions. Do not look to go long, and tighten stops, but don't run for the hills yet, until further weakness occurs.

Stocks could launch from here to new highs. They could also drop, but if you are working with proper risk management, sometimes it pays a lot more to stay in, at least partially, during sideways moves. For instance, my experimental trading strategy for the POS has 1/2 a position on the current market. It has taken money off the table sure, but it will benefit if stocks resume an uptrend from here as the position is anchored back into December 22, when the POS revved up to a 7.

Discipline: Strap Me to the Mast!

Any good trading or investing strategy is designed to give us an advantage. That's why strategies exist. They are rules to make us a profit in the long run. The problem, however, is our psychology is not good at following long term strategies. We crave the short term payoffs and despise any short term pain. The problem comes when we abandon good strategy to appease our emotions. It is at that moment when we throw our well-designed and thought-through advantage to the wind and expose ourselves to the perils of pure gambling and sentiment.

Strategies that catch the high flyers are particularly prone to human weakness as something that is making new highs inevitably will correct or reverse trend eventually. For instance, there are a lot of holdings heading to the moon like Long Term bonds, the US dollar, and inverse commodities. The more weeks that these holdings march forward, the more weary our minds get of the coming pullback. We know it cannot last forever.

I have seen many technical articles about the coming reversal in US bonds or the dollar, for example, and I can't help but agree with their arguments. However, if I were to abandon my strategy before this inevitable weakness showed up, I'd be throwing away the very system that allowed me to profit from them in the first place. I can't both profit from these trends and also completely avoid the first stages of those trend reversals (under my principles). Thus, no matter what I have to stay committed to the rules. The rules may allow for short term weakness, but they are designed for long term gain. And, as good as short term gain FEELS, long term gain is all that matters in the end.

It can be tough, but as long as your system is designed to be self-correcting or risk managing, it will carry you through the rough patches. Don't give up. Your greatest financial enemy is often yourself.....and most definitely the financial media.... Also, make sure your strategy rests on sound principles, it could just be bad....

Overall

Deflationary assets (bonds, dollar, inverse commodites, defensive stock sectors) continue to lead and black clouds remain over the US stock market. However, there has been much buzz over EU QE this week, which may coincide with a shift to a new set of leaders as 2015 continues. It will be interesting to watch. Also, have you seen the big moves in both the Swiss (franc) and Chinese ($SSEC) markets due to big surprises this last week? A lot of money is moving in these shocks.

For the coming weeks, I will navigate whatever comes even if I have to strap myself to the mast. Can you say that for your strategy?

For the coming weeks, I will navigate whatever comes even if I have to strap myself to the mast. Can you say that for your strategy?

No comments:

Post a Comment