[This post features

content from my discontinued blog, Specwinds. The information in

article may be edited from its original form. This particular post features outdated forms of analysis which I no longer use. However, it is interesting for its use of different charts to notice trends and relative strength. The post also includes a high level of speculation over why the price is what it is. Today, I hesitate to speculate too much unless it is not serious. The market features too many variables and inputs to explain exactly why certain changes in price are occurring. The good news is that you do not need reasons why to be a successful investor. You simply have to be active and aware, using the actual pricing data to determine where to allocate resources.]

From 4/26/2014-The Market is Changing

**Update: 5/13/2014- Having had some more time to observe the markets, I want to emphasize my concerns with the consumer discretionary sector of the US economy. Whether it is inflation, wage stagnation, student loans, restructuring of the retail sector, etc... the market seems to be pricing risk centering around the activities of the US consumer. Also, one aspect of commodity price analysis which I don't consider below is seasonal effects. This variable may also be affecting what is happening in commodity prices.

This article contains information on current macro-trends in global financial markets based on price movements. I will show how the frustrating lack of progress in the US stock market is a signal for changing economic conditions that may indicate a shift towards the economy adapting to price inflation. It is important to remember that these observations can constitute no more than forecasting like the weather. Nothing is for certain in the markets, but like a meteorologist, one can use the present data and probability based on observable trends to identify what the odds are for certain outcomes. This article is providing evidence for the market pricing in an increasing risk of higher inflation. You may read the following for further information I do not cover:

This article contains information on current macro-trends in global financial markets based on price movements. I will show how the frustrating lack of progress in the US stock market is a signal for changing economic conditions that may indicate a shift towards the economy adapting to price inflation. It is important to remember that these observations can constitute no more than forecasting like the weather. Nothing is for certain in the markets, but like a meteorologist, one can use the present data and probability based on observable trends to identify what the odds are for certain outcomes. This article is providing evidence for the market pricing in an increasing risk of higher inflation. You may read the following for further information I do not cover:

I highly recommend Chris Ciovacco's weekly video for an update on current market conditions. You can find the video with a survey of various charts at the link below:

http://ciovaccocapital.com/wordpress/index.php/stock-market-us/reasons-to-keep-stocks-on-a-short-leash/Also, I recommend reading the following intermarket analysis on the changes in the business cycle from David Calloway on Stockcharts.com:

http://stockcharts.com/public/1842472

Stock market has failed to make significant progress in 2014

I provide my own daily chart here of VTI's progress since August 2013 to highlight the concerning picture for stocks on the short-term time frame and indecisiveness in the bull/bear battle over pricing.As you can see with the green and blue trendlines, the total stock market has been in an upward sloping channel with relative support around the 100-DMA. As you can see, prices bounced off the lower trendline in late August, mid October, late January, and early April. This bottom rail of support has continued to hold which is bullish for stocks, however, it is evident things have changed since 2014 began. As noted by the blue circles, stocks quickly and bullishly rose to meet the green upper resistance of the channel after every pullback until the most recent pullback in April. As noted by the red circle, price has actually turned over prior to reaching the green target area as represented by the green circle. The upper resistance line at about $98 dollars has held since early March, preventing price from advancing along the green upper trend line as it has previously in 2013.

Growth and Expansionary Sectors Show Weakness

John Murphy's chart summarizes what has been happening in terms of relative strength and weakness and strength among the sectors. Short-term PerfCharts like these are always worth keeping in mind:

As can be seen in Chris's excellent video posted above, a decreasing MACD line is a troubling sign for any asset on the monthly scale. Such decreasing values often signal further declines are in the works. While the Dow and S&P 500 have relatively remained in place, growth stocks and cyclicals have begun to decline such that their weakness is evident on a monthly scale. Note that the candlesticks below are Henki-Ashi candlesticks, which reduce volatility to identify trends by adhering to specific rules that derive a new candlestick from actual open, close, high, and low value data. As you can see, the red Henki-Ashi candlesticks are bearish and white ones are bullish.

I mark with red lines the negativity present in each chart and the negativity relative to VTI. The charts show decreasing MACD lines, red candlesticks, and relative weakness to VTI:

The NASDAQ, Small Cap Growth, and Consumer Discretionary ETFs are shown above, each representing sectors of the stock market you would expect to show strength when market outcomes are expected to be bullish for US stocks.

Consumer-Oriented Sectors Such as Retail also Showing Weakness

I also include ITB and XRT, the homebuilders and retail stocks. Both sectors are sensitive to consumer spending as housing and retail demand are sensitive to the consumer's spending habits. Both are showing the same weakness as growth stocks, possibly suggesting consumer spending will be compromised or profits from consumer spending will decrease.

Commodities Showing Relative Value and Strength

I highlight the formation of potential breakout patterns and value relative analysis between the price of stocks and commodities, showing the historical under-value of commodities to stocks that may cause upward price pressure on commodities as investors look for the best deals.

We see the price of oil forming a sideways triangle that may breakout soon as volatility is decreasing over the years. The price relative of oil to stocks is near a multi-year low, around the area where oil prices found a bottom against stocks in late 2008 and proceeded to outperform stocks until 2011. Oil's MACD line is also showing positivity.

$CRB is an index that tracks a wide range of commodities. As you can see, its monthly chart is also showing positivity and it is historical underpriced relative to stocks based on the last seven years.

Silver is unique as both an industrial and precious metal. Its graph also shows relative value and positivity.

These are just a few of the charts I could have shown that echo the same message of upside risk to commodity prices.

Commodity Sensitive Equities Showing Relative Strength

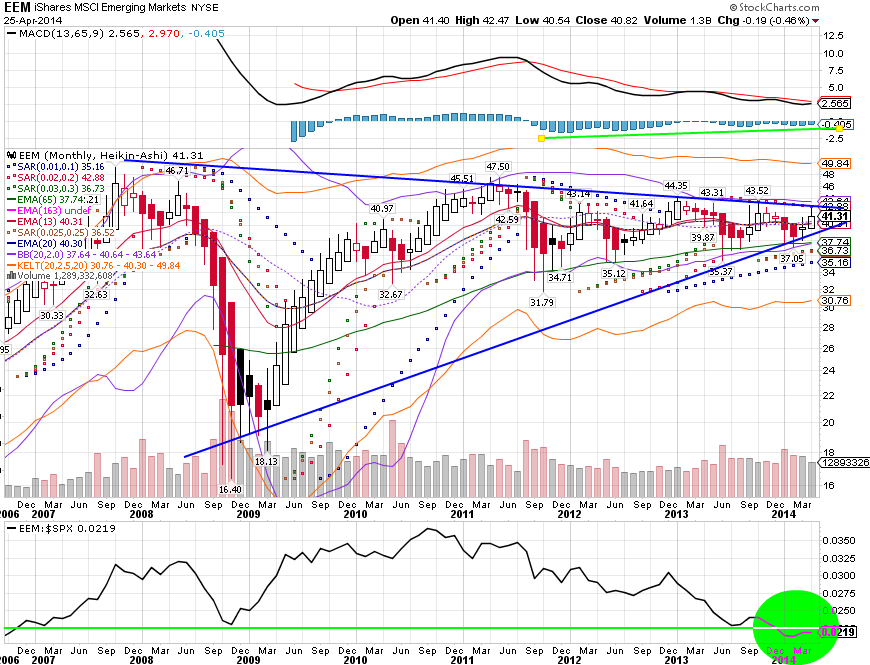

Looking at the commodity sensitive emerging markets (EEM), we can see it looks almost the same as the price of oil with its MACD positivity, sideways triangle, and relative undervaluing to stocks. Emerging markets may begin to outperform US stocks if commodity prices rise.

I have produced an additional graph showing relative strength in the commodity producing countries including Brazil, Canada, and Australia. I have charted these countries relative to the inverse value of the US dollar, a proxy for inflation (decreasing value of the dollar).

Finally, I have charted commodity sensitive US sectors (XLB and XLE) with the inverse dollar in addition to the relative performance of value stocks versus growth stocks on a monthly scale. Value stocks tend to outperform growth stocks during times of rising inflation. As you can see, all these measures are showing positive movement i.e. outperformance of value over growth and commodities versus total US stocks.

Putting the Story Together: Commodity Risks to Upside and US Growth Risks to Downside due to Inflation Risk?

I chart below a range of inflation sensitive prices including Gold Miners, which often precedes rises in gold prices, the inverse dollar, $CRB, and short-term interest rates, which rise with the fed's efforts to tame inflation. As the green circle shows, all these charts are showing positivity with monthly higher highs and higher lows, evidence of a upside movement.

After considering the evidence I provide here, read the following correlations between inflation and asset prices:

http://www.investopedia.com/articles/investing/052913/inflations-impact-stock-returns.asp

In addition, consider the commentary on Fed activity provided below:

"What ought the Fed to be doing right now? The Fed ought to be tightening. Though growth is not robust, "robust" growth cannot be the standard demanded before starting a tightening of monetary policy,especially when there are tremendous excess reserves. The monetary policy car has no traction with such huge reserves, and the Fed needs to start trying to get control so that when it is time to steer, it can do so. Moreover, with disinflation fears waxing - incredibly - at the FOMC, inflation is in fact heading higher. Median inflation should approach or exceed 3% this year, despite the Fed's belief that it will be well below 2% for a very long time. In a few months, the fear of disinflation and deflation will seem quaint."

-The Inflation Trader, Seeking Alpha Commentator, April 10th, 2014

No comments:

Post a Comment