I update my market models weekly and monitor the trends in their allocation numbers. While I do not follow every market, I follow many important markets via their representative ETFs. There is a list of the current ETFs I am tracking in the sidebar. Here is a run through of this weeks observations.

While I analyze the markets using measures of absolute momentum, I include performance charts here for a quick and dirty illustration of performance. Where I wish to specifically show momentum, I use MACD charts.

One of my models is a simple allocation program between the total stock market, VTI, and long term government bonds, TLT. The current allocation for this program is Balanced (about 1:1 stocks:bonds). However, this week saw a shift towards TLT with the weakness in stocks

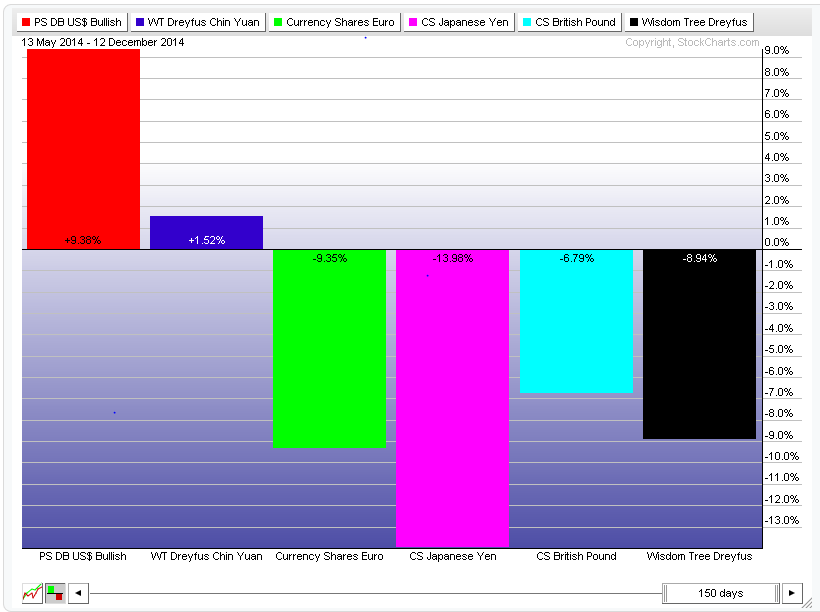

In the currency markets, the US dollar and Chinese yuan are still seen as favored even with their short term weakness:

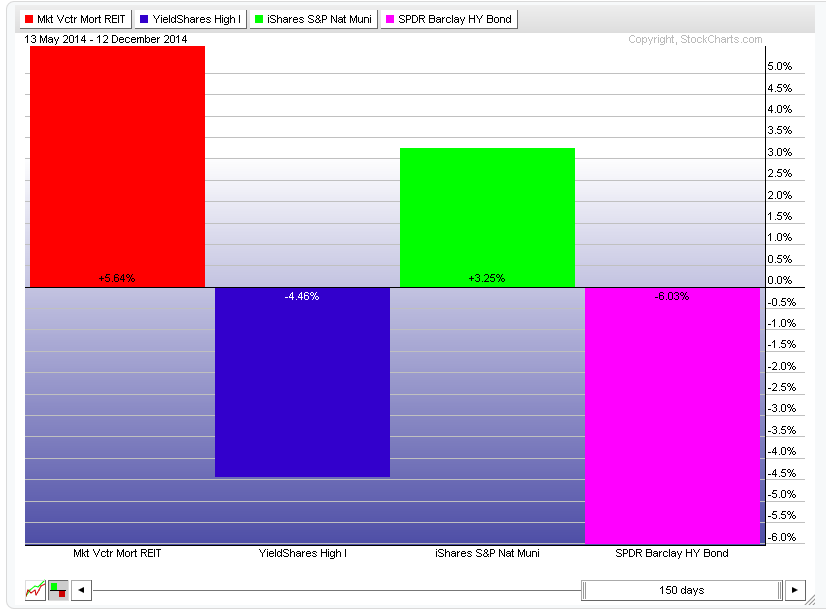

In the income world, this week saw a huge shift away from closed end funds, coinciding with weakness in the high yield bond space in general- probably correlated due to leveraging costs and risks. However, munis and mortgage income still look good with the current interest rate environment:

There is negative momentum in all time frames I track for JNK, the high yield bond ETF:

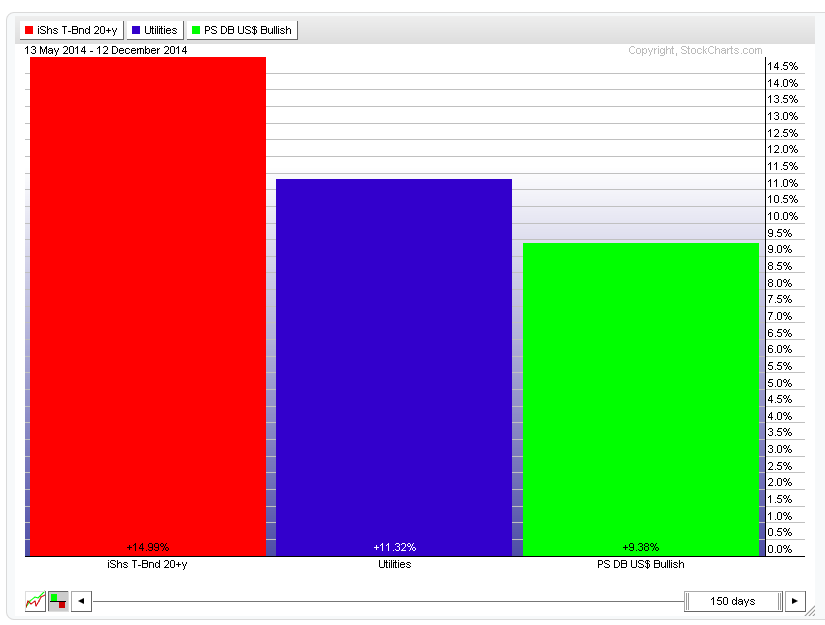

In terms of general trends, the traditionally defensive or deflationary sectors are leading:

In other macro trends, the Russian

markets are tanking along with oil, look out below!

In intermarket relationships, large caps are losing ground against small caps; SPY is lagging and IWM gaining strength in terms of relative momentum:

Finally, the POS market score is currently at a 1 reflecting the current negativity in US markets. I am currently in cash in my market swing trading account as I wait for the next upthrust as the markets catch their breath.

See you next week!

No comments:

Post a Comment