[This post features

content from my discontinued blog, Specwinds. The information in

article may be edited from its original form. This particular post d

evelops an active investment strategy that identifies losers and winners using a form of relative strength. This bears some resemblance to stockcharts.com's new Relative Rotation Graphs

http://stockcharts.com/freecharts/rrg/. I do not use this strategy currently, but the idea behind it has continued to evolve and its DNA is present in my current strategy.]

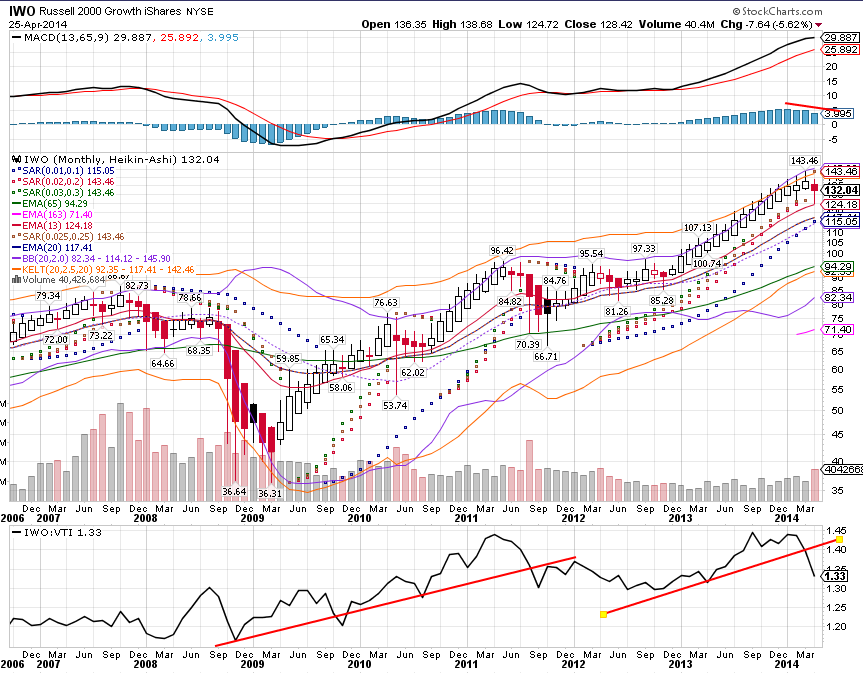

From 2/2/2014-

Over the weekend, I investigated another method of evaluating potential trade and investment options. This method of analysis is powerful as it enables one to categorize any stock or ETF according to its relative performance versus a benchmark. This method relies on the capture ratio, or the amount of up movement on up days of a benchmark versus the amount of down days on down days of a benchmark. In other words, one can find out how high a stock has gained value on "up days" of a benchmark and how much it has lost value on "down days" of a benchmark over any period of time. Morningstar.com provides this information for 1, 3, 5, and 15 years on most ETFs, but I wanted a shorter time length to capitalize on shorter term movements, and the ability to work with stocks.

Therefore, using Nasdaq.com's historical price data (as of 1/31/14) and Excel, I produced a spreadsheet that calculates capture ratios for any set of price data compared to any benchmark data. For my purposes, I chose VTI, so I could evaluate stocks and ETFs according to the performance of Vanguard's Total US Stock Market fund.

The following is an example of the up capture % calculation: IF VTI's (Day(X)'s Close / DAY(X-1)'s Close)-1 > 0, THEN, % Up for Fund or Stock (Z) = Z's Price Data when VTI has up day or SUM((Day(X)'s Close for Z / DAY(X-1)'s Close for Z) / VTI's Price Data when VTI has up day or SUM(Day(X)'s Close for VTI / DAY(X-1)'s Close for VTI). The down ratio is computed similarly, but data is selected for VTI's down days, or when (Day(X)'s Close for VTI / DAY(X-1)'s Close for VTI)-1 < 0.

Then, I graphed a variety of funds and stocks using the up and down capture percentages as x and y coordinates, where x=down capture % and y= up capture %, giving me a useful visual, which I then modified with Photoshop for the overlay:

Interpretations and Importance

VTI's score is represented by (100,100) on this graph as VTI gains 100% and loses 100% when VTI has up days and down days. This is the joining point of all the colored regions and where the most clustering is found. The clustering around (100,100) makes sense as the majority of stocks and funds are correlated closely with the progress of the entire index or benchmark. However, where a fund or stock lies relative to (100,100) is telling for what performance you would have realized if you had invested in that fund over the last 6 months.

For instance, the best funds lie in the green box. The green box represents those funds with a down capture score of <100 and and up capture score of >100. Why were these the best? Because having a score like (80,130), for instance, means that the fund realized 80% of the down movement of VTI (i.e. 20% less), while realizing 130% of VTI's upward movement (i.e. 30% more). As one can see, such a green box fund outperformed VTI on both VTI's up days and and down days, meaning it gained more when VTI was positive and lost less when VTI was negative.

Another point of note is the red diagonal line with formula y=x. VTI is on this line at (100,100). Any fund that lies on this line, or is close to it, moves at some factor proportional to VTI. For instance, JNK, the high yield bond fund has a score of (22,22), which means it had a down capture of 22% and up capture of 22% relative to VTI. Therefore, JNK on average, moved the same direction as VTI for the last 6-months, but at a magnitude of 22/100, so it gained less and lost less, but in the same direction as VTI. This diagonal line separates the overperformers from the underperformers as being above the line means a fund is an overperformer with greater up capture than down capture (y>x).

Finally, there is a volatility measure present in this analysis as well. As you can see from the High Vol. and Low Vol. dimensions, the higher the score above 100, the greater the volatility or the greater the magnitude the movements that fund is experiencing relative to the benchmark. A hypothetical fund with score (320,400), for instance realizes 320% the downside and 400% the upside of VTI over the past 6 months.

Why do I have a blue section? Well, I distinguish the blue from green sections by the downside risk they presented over the past 6 months. If a fund was in the blue section, it is going to outperform in an uptrend for VTI (when # up days >> # down days). Why are these problematic? If VTI is experiencing sideways activity, these blue section funds become less attractive as they are outperforming on the upside AND underperforming on the downside. Therefore, as # up days approaches the # of down days, these funds will start to underperform and their higher volatility will become a disadvantage relative to green section funds.

I have included the top ten listings on the ARCA Institutional Index on the chart above, which are the top ten stocks held by hedge funds. Notice where they are located. The majority of them are in the orange section (PG, WMT, CVX, JNJ, XOM, T, etc). Only 2 of them are in the green section (GOOG and MSFT). What this means is that the majority of the top held stocks underperformed VTI over the past 6 months. Only investors holding GOOG and MSFT would have beat the Total US Stock Market. What's cool about this result is it reaffirms the outperformance of index funds in uptrending markets such as occurred in the past 6 months. Notice that Berkshire Hathaway (BRK/B) lagged the total market as it is located in the red rectangle (Some claim owning BRK/B is like holding a mutual fund. If this is true, than it was a poor choice of fund for the past 6 months. Historically it is important to note BRK/B does best in the long term by outperformance during bear markets).

How Could this Information Be Used?

The classic technical analysis fallacy that past performance predicts future performance is certainly important with any look-back strategy and analysis. As such, the warning that such past-based analysis may mean nothing for the future is certainly in play. However, fund and stock performances do tend to last for actionable periods of time. Thus, there is a higher probability that funds and stocks experiencing outperformance will continue to do so in the weeks and months ahead.

Fund performance can be predicted by performance of the benchmark. Using the info in the chart above, I can guess what a fund will do on a given day given VTI's performance for that day. Thus, VTI's trend direction becomes a useful tool for determining what to buy. As I mention above, green section picks are all excellent options when VTI is in a long and intermediate term uptrend, while blue section picks will rocket higher when VTI is in a short term uptrend and experiencing multiple up days in a row.

Obviously, graphing the performance of a hypothetical portfolio comprised of these stocks and checking its performance over the last 6 months would represent the ideal outcome if one had traveled to the future and invested in July 2013 in the funds known to have outperformed by January 2014. However, even though this is the ideal (past performance matches future performance), it gives an idea of the power of the capture ratio if some of that historical outperformance continues forward into the future.

I used Motif to construct the ideal capture ratio portfolio, weighted by how far the option entered the green section relative to (100,100). I then used Motif's webpage to graph the six month performance.

Look at the green and red lines! The power of the capture ratio causes the portfolio (blue line) to form a positive divergence to VTI (orange line). This means the portfolio as a whole increases in value as VTI goes sideways. This portfolio also outperformed VTI by almost 10%! over this period (15% vs 5% gains).

A powerful strategy could attempt to achieve some significant fraction of this type of ideal outperformance by continually rebalancing a portfolio constructed from the latest capture ratio data for a set of funds or stocks. This measure could also inform about which stocks to pick in different market environments. When its time to be defensive, lower volatility stocks or funds would useful in general.

Check out the performance of the portfolio constituted of blue sector funds above! As we know, VTI experienced an extended up trend with # up days >> # down days, so the blue sector's volatility would have been an advantage over this period. This portfolio gained 22%, outperforming VTI by 17% and using no leverage! One could hypothetically swing trade blue sector funds whenever VTI is safely in a short term uptrend. For instance, if one had bought this portfolio on Dec.16th and held until Dec.31st, when the markets where safely in the Santa Claus rally, a 5.5% gain could have been realized in two weeks (the total performance of VTI for the past 6 months!).