As per the internal rules for the Point of Sail Index, a market SELL signal occurred today, 12/23/2015, so the open LONG position will be closed at the market close tomorrow, 12/24/2015.

For more on the POS Index and the trading system, visit: POS Market Scores History Explained

Wednesday, December 23, 2015

US Economic Health Analysis Complete for November 2015

Current Summary

Updated: 12/23/2015

AS OF THE END OF THE MONTH- NOVEMBER, 2015:

BIG 4: THE US ECONOMY IS GROWING

**Caution, the Industrial Production is weak in 2015

RISK 4: FINANCIAL RISK IN THE US ECONOMY IS LOW

MASTERPHASE: THE US ECONOMY IS ADVANCING

**Caution, the Industrial Production is weak in 2015

RISK 4: FINANCIAL RISK IN THE US ECONOMY IS LOW

MASTERPHASE: THE US ECONOMY IS ADVANCING

For full report, please visit:

http://www.maintrimmercapital.com/p/us-economic-health.html

Friday, December 11, 2015

POS Signals Long Position on US Market!

As per the internal rules for the Point of Sail Index, a market BUY signal occurred yesterday, 12/10/2015, so a long position was opened at the market close today, 12/11/2015.

I noted the confusion of using only "LONG" and "CASH" to show the signals as the rules call for the trade to occur the day after the signal. Thus, I will add a third option, "SIGNAL" to show that a signal has triggered and a trade will be opened or closed at the end of the next trading day. For example, the LONG signal triggered yesterday, but the trade opened today, so yesterday shows "SIGNAL" and today shows "LONG."

For more on the POS Index and the trading system, visit: POS Market Scores History Explained

I noted the confusion of using only "LONG" and "CASH" to show the signals as the rules call for the trade to occur the day after the signal. Thus, I will add a third option, "SIGNAL" to show that a signal has triggered and a trade will be opened or closed at the end of the next trading day. For example, the LONG signal triggered yesterday, but the trade opened today, so yesterday shows "SIGNAL" and today shows "LONG."

For more on the POS Index and the trading system, visit: POS Market Scores History Explained

Thursday, November 19, 2015

Two Struggles of Content Selection for a Systematic TA Blog

One may wonder why I post infrequently on Maintrimmer Capital. There are a two basic reasons. I thought I'd share them here because the discussion itself sheds light on the woes of substantive financial media.

1) Doing Over Reporting

The main reason I find it difficult to post is because I spend most of my financial hobby time working on trading strategy development. If one is serious about trading and has experience with the markets, you learn quickly that there is no all-in-one solution to navigating the markets.

Every decision in trading design will have its fair share of benefits and problems. The complexity comes in balancing these issues while deciding what you want your system to do and determining whether it works. Sometimes, this means running a system for a few months just to get a feel for what it accomplishes. Every tweak sets you back as now your system parameters have changed, so you reset the clock.

This process is time consuming and takes brain power, but it is worth the effort and interesting in its own right if you like this sort of thing. This classic meme captures the challenge trading presents the mere mortal:

2) Market Observation or Market Prediction

A serious study of the market beats you over the head with a simple truth: the markets are fundamentally unpredictable. This statement is true in the sense that if they were, there would be no payoff to being a good trader.

The problem, however, is that anything that has an uncertain outcome that you wish to profit from can quickly lead you down the path to market spectating as entertainment.

This is the fundamental problem of the financial media. We all know it is exciting to gamble! The media knows this and so it floods the airwaves with professional speculators. People willing to say the market will go any which way with no real clue over what really will happen.

Some may have a clue, but the problem is no one person has control over the future. However, true market reporting then should be couched in probabilistic terms to have legitimacy.

To talk in this way is less exciting. Saying the markets might do x, y, or z sounds frivolous. On the other had, we all love someone who confidently tells us x, y, or z will happen with certainty. Humans are attracted to control and we flock to people who sound like they know what will happen.

Maybe, those in the financial media understand the probabilistic nature of markets when they tell us to hold stocks for the next few weeks after a big rally.

But, I feel they do the common person a disservice when they do not reiterate this uncertainty every single time they make a prediction. Yeah, its not as exciting to sound like you do not know for sure what will happen. But, should financial reporting be more about style or substance?

Trading can be gambling and it can be expensive entertainment for some. But, that will always be true, so why not focus with seriousness on the real risks and drawbacks of market predictions. This information often effects real people's real savings after all.

For humor relating to the fin. media, look no further than the way CNBC's Dennis Gartman is treated like a punching bag online by traders. To give you an idea, some traders propose actively taking the opposite side of every trade Gartmen suggests.

So what?

Even stockcharts.com, one online harbor for technical analysts, produces weekly videos and blogs that involve a round up current market conditions with hints at future direction. Therefore, useful ways exist to report on market activity without acting like a soothsayer. Both Dr. Wish and Chris Ciovacco also have there own way of sharing that have allowed me to enhance my own techniques.

I do want to participate in the online community of traders, but I am still working on how best to share my interests. At the least, I am happy to have my Point of Sail Indicator and Market Heat Index running everyday, which captures daily market moves in a numerical way. These indicators can be used to interpret relative movement in the markets.

You can see market breadth strengthen and weaken over time with the Heat Index. The Point of Sail Score can give you an idea of the relative overbought or oversold level of the market (3's and 4's are oversold and 1's and 0's are overbought).

The Point of Sail Indicator is also connected to a public trading system that is featured on dark-liquidity.com. Ironically, it is currently not trading as market conditions are not best for Longs based on its internal trend following rules. But, eventually, it will start trading again as the markets evolve.

Stay tuned for more as I continue to hone my interests. Do not forget that learning curve diagram above. It is not that far from the truth. I have been working on my trading identity for two and a half years now. I still have much to learn, but I am getting there.

Wednesday, September 9, 2015

The Existance of Leveraged Bubbles and their Damaging Effects

Today, I share an interesting study on the effect of equity and house price bubbles on developed economies. Here's a summary of the article and the link:

"In this column, we turned to economic history for the first comprehensive assessment of the economic risks of asset price bubbles. We provide evidence about which types of bubbles matter and how their economic costs differ. Our historical analysis shows that not all bubbles are created equal. When credit growth fuels asset price bubbles, the dangers for the financial sector and the real economy are much more substantial. The damage done to the economy by the bursting of credit boom bubbles is significant and long lasting.

In the past decades, central banks typically have taken a hands-off approach to asset price bubbles and credit booms. This way of thinking has been criticised by some institutions, such as the BIS, that took a less rosy view of the self-equilibrating tendencies of financial markets and warned of the potentially grave consequences of leveraged asset price bubbles. The findings presented here can inform ongoing efforts to devise better macro-financial theory and real-world applications at a time when policymakers are still searching for new approaches in the aftermath of the Great Recession."

"In this column, we turned to economic history for the first comprehensive assessment of the economic risks of asset price bubbles. We provide evidence about which types of bubbles matter and how their economic costs differ. Our historical analysis shows that not all bubbles are created equal. When credit growth fuels asset price bubbles, the dangers for the financial sector and the real economy are much more substantial. The damage done to the economy by the bursting of credit boom bubbles is significant and long lasting.

In the past decades, central banks typically have taken a hands-off approach to asset price bubbles and credit booms. This way of thinking has been criticised by some institutions, such as the BIS, that took a less rosy view of the self-equilibrating tendencies of financial markets and warned of the potentially grave consequences of leveraged asset price bubbles. The findings presented here can inform ongoing efforts to devise better macro-financial theory and real-world applications at a time when policymakers are still searching for new approaches in the aftermath of the Great Recession."

Friday, September 4, 2015

The POS is Live on Dark-Liquidity.com!

A big thank you to Dark-Liquidity.com for adding the Point of Sail Index to their site. I discovered the Dark Liquidity blog back when I first started learning about the markets and systematic trading.

Now, the POS is included alongside some of the other market indicators and trading systems put out by blogs across the net. The blog is really useful for comparing and exploring different ways of navigating the markets. I am happy that I can contribute the POS to further technical analysis and systematic trading as alternatives to approaching the stock market!

If you haven't had a chance to check the check them out yet, visit the Dark Liquidity blog and the POS page at:

http://www.dark-liquidity.com/page16.php

Wednesday, August 12, 2015

Epic Intraday Reversal...Still No Major Change in State of Average Stock

The indexes saw a major intraday reversal, regaining over a percent of value after dropping overnight and into the morning.

What I'd like to see in a bull thrust like today is many stocks participating in the moves by improving in technical condition. However, my market heat index yawned with today's move, actually dropping a point from 32 to 31 degrees.

The bullish percent portion of the index actually hit a new low today.

I'll be looking for more motion in the heat index in the positive direction to really trust in a sustained bull thrust. Otherwise, my posture remains defensive as I heed the warning of the -1 POS score.

What I'd like to see in a bull thrust like today is many stocks participating in the moves by improving in technical condition. However, my market heat index yawned with today's move, actually dropping a point from 32 to 31 degrees.

The bullish percent portion of the index actually hit a new low today.

I'll be looking for more motion in the heat index in the positive direction to really trust in a sustained bull thrust. Otherwise, my posture remains defensive as I heed the warning of the -1 POS score.

Tuesday, August 11, 2015

2015, Educated on Currency Risk Yet?

The news of the day is the PBOC's decision to devalue the yuan by 2%, causing a massive change overnight.

I am reminded of the Swiss Bank's unpegging the Franc from the Euro earlier this year.

Currencies typically have lower volatility than other assets like stocks. This feature is why many Forex traders use large amounts of leverage to trade these assets. However, 2015 is here to remind you that central banks, not the markets, have the final say on the value of currencies.

Yes, even currencies can have major gaps that ruin trading strategies in one fell swoop! Always keep risks in mind when trading even the most low volatility assets.

I am reminded of the Swiss Bank's unpegging the Franc from the Euro earlier this year.

Currencies typically have lower volatility than other assets like stocks. This feature is why many Forex traders use large amounts of leverage to trade these assets. However, 2015 is here to remind you that central banks, not the markets, have the final say on the value of currencies.

Yes, even currencies can have major gaps that ruin trading strategies in one fell swoop! Always keep risks in mind when trading even the most low volatility assets.

Monday, August 10, 2015

POS Update Complete!

I have completed my revision to the Point of Sail Indicator. The Explanation page has been updated to reflect the changes. Please visit to learn more about what is new! http://maintrimmercapital.blogspot.com/2014/11/point-of-sail-market-score-history.html

Highlights:

Highlights:

- The POS now takes a professional, contrarian view to trend following, encouraging buying weakness and selling strength, helping you to manage risk when trading or modifying portfolios

- The underlying index that uses binary questions to objectively analyze the markets was not modified, just the filters to derive the final output number to encourage better trading

- An objective Long Term trend analysis component was added to further improve the POS. The -1 score warns that the long term trend is weak or neutral, not ideal for bull market short term swing trading.

- The POS data now goes back to late 2011!

- A trading system was developed using signals from the POS. Using UPRO as the trading vehicle, the system returned 300% since 2012 and had positive returns every year.

- The Market heat index was completed and is now the ultimate breadth indicator for the site.

Again, I invite you to visit the explanation page for more details!

Wednesday, August 5, 2015

The Point of Sail Index is being Updated!

I am excited to share that I will be improving the POS indicator! While the underlying index and its calculations will not change, I will be adding a few new features and screens to determine the final signal output. The new signal outputs will be much more amenable to short term swing trading. I will also share a trading strategy to make the best of these new changes. Stay tuned for final changes by the end of the week.

Wednesday, June 24, 2015

Looking Under the Market's Hood

No matter what your preferred strategy for navigating the markets, systemic risk will always make your strategies vulnerable to what is happening to the market as a whole. Therefore, in order to be more informed about what current market action is indicating, it is useful to track current market conditions beyond the simple price quotes shown in bottom corner on CNN.

Technical analysis offers an insight into the movements behind the day to day price fluctuations of the total market by tracking the technical condition of individual stocks and combining the scores to achieve an overall picture of what is contributing to the market's move.

The class of indicators that utilize this strategy are often called Breadth Indicators as they measure the extent or range of participation by individual stocks in the market's overall movement.

In this article, I will briefly share some of the popular breadth indicators and how to make your own.

Bullish Percent

Number of stocks on P&F buy signals/total number of stocks

The Bullish Percent Index is calculated by finding the % of stocks on a Point & Figure Buy signal for a given index. For more explanation, visit Point and Figure Explained.

Bullish Percent Indexes are calculated for many different indexes. For example, if you want to know how gold miner stocks are performing as a group, look at the Bullish Percent index for Gold Miners ($BPGDM on stockcharts.com).

When interpreting a Bullish Percent Indicator, look at the historical movements of the indicator alongside the price for that index. This will allow you to determine absolute values to watch. For instance, 70% is commonly marked on a chart of the $BPSPX, as strong bull markets tend to live above this number. You can also identify divergences between the price of the index and the BP index when the BP index is not moving in same direction as price. For example, if the BP stays flat for a few days while price is rising, then the markets may be at risk for a reversal as bullishness has decreased such that more stocks are not entering a bullish state as the index advances.

New High - New Low

Number of stocks at 52-week highs - Number of stocks at 52 week lows

The New Highs-New Lows Index ($NYHL for NYSE) is a popular indicator and can often give hints to future price movements. If there are more stocks being bid up to 52-week highs, than sold down to 52 week lows, then bullishness is likely more prevalent than bearishness in the market.

While you can look at divergences in the $NYHL versus price, I like to watch absolute values. Obviously, the zero level is important to watch as it marks the divide between more 52 weeks than 52 week lows. One can also draw a line at 75, just looking at the chart above, as a surplus of 75 more stocks at 52 week highs than lows often occurs in a strong bull market advance. Drawing lines at negative values can help you track the strength of bearishness in the market as well.

Net Advance-Decline Issues

Number of stocks with a gain for the day - Number of stocks with loss for the day

The $NYAD is another straightforward indicator, shown above in its cumulative form, where each daily value is added to the prior day's $NYAD value to track overall movement through time.

The cumulative $NYAD is most commonly watched for divergences. If price is rising, but net A/D is decreasing then less stocks are participating in the rally, possibly signalling a decline in bullishness.

Customized Breadth Indicators

You can easily make your own breadth indicator if you understand the basic principles of technical analysis. If there is a favorite scan you use to find stocks in some bullish situation, then simply apply that scan to all members of an index, and divide the number in that bullish state over the total in the index.

The POS Indicator on the right column of this website shares the logic of a breadth indicator as it diagnoses the technical state of a select group of indexes and indicators to track current market conditions. For more, visit the Point of Sail Indicator.

Moreover, the BPTOT is a custom bullish percent indicator I report alongside the POS that applies the logic of the Bullish Percent calculation to three indexes that I have chosen. Using stockcharts.com, I scan for the number of stocks for selected indexes on a P&F buy signal and then divide the result by the total number of stocks in the index I select.

For my private use, I also utilize a Bullish vs. Bearish Issues indicator inspired by the New Highs-New Lows Index. In this case, for a select index, I run a scan for a bullish set of conditions and a scan for a bearish set of conditions. The two values are charted here:

I can then subtract the two values to have a New Highs-New Lows-like indicator.

It is well worth studying breadth indicators to improve your understanding of the markets. Having a tool set of breadth indicators will help keep you informed about current market conditions beyond the daily price fluctuations.

Point of Sail Index Update

The Point of Sail Index has a new look! The underlying calculations have not changed. However, the original scoring system that produced an index with a maximum value of 8 has been consolidated, reducing indication volatility, to produce an index with a maximum value of 4.

Please visit the Market Scores History Explained to review the POS Index.

Please visit the Market Scores History Explained to review the POS Index.

Wednesday, April 22, 2015

Should I Sell Some of my Bond Position and Invest in Europe?

In this article, I will address a question financial advisers are considering for their clients' portfolios. With the ECB easing, many US investors may consider investing in Europe, potentially taking money out of their bond funds, which have appreciated considerably over 2014 to invest. Is this a good idea? Let us see how technical analysis can help.

What do the charts say?

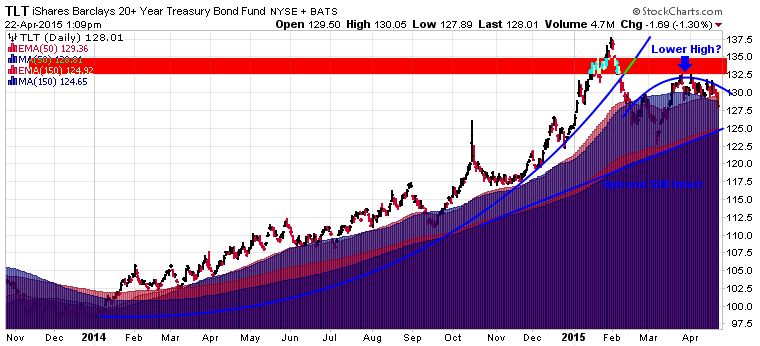

First, let us look at the chart of TLT, the long term US government bond fund. This fund increases in value as long term yields decrease and is a good proxy for the performance of long term bond funds.

We can see the huge parabolic run up in bond prices throughout 2014, with prices peaking in January 2015. Prices broke out of the parabolic rise and sold off all the way to the 150 day EMA by late February. Since then, bonds may be putting in a lower high, the beginnings of a potential trend change. However, it is still early to call a top in bonds and bottom in long term interest rates. The long term uptrend is still intact. I would look for a break of the 150 EMA near $125 to confirm further weakness in bonds. A successful break above $133 would negate the topping formation.

While it is early to call a top in bonds, it may be useful to keep the very long term picture in mind from my previous article which showed prices hitting the top of a 30 year trend line: http://www.maintrimmercapital.com/2015/02/the-last-time-this-happened.html

What about Europe, as represented by the VGK?

VGK is farther along in a trend reversal than TLT on the daily time frame. With a higher high and higher low after the sell off in the second half of 2014, VGK looks positioned to continue higher. A successful break above $57 would confirm this strength. A short term value purchase for this stock is just above the marked higher low near $52.50 on any pullback. While VGK's daily chart looks good, the potential for a larger decline is still present on a longer time scale. The 2015 rally could technically be a bear market rally. This option would only be confirmed if VGK fails below $52.5 into its prior lows. The 2014 sell off was not excessive (<20%) and the global environment for equities is currently favorable, so a turnover while possible is unlikely.

Finally, we will look at the VGK:TLT relative price chart:

TLT has clearly been outperforming VGK since early 2014 will the moving averages in bearish mode in to 2015. However, at the far right, we are starting to see the short term red moving average peak out from underneath the long term blue moving average, which may indicate future trend change where VGK will outperform TLT. This chart mirrors the TLT chart in confirming historical strength in TLT, but potentially indicating the beginnings of TLT underperformance.

What is the verdict?

The strongest chart is the VGK chart as it appears in the late stages of a bullish trend change, so an investment in Europe will likely be profitable going forward. If one wanted more information from price to decide whether to sell TLT and buy VGK, then watching TLT closely going forward will be crucial. If TLT progresses in its potential bearish trend change, then VGK will clearly be favored going forward. While TLT has yet to confirm a trend break, if one had to choose today, it appears risk is higher to the downside for TLT and to the upside for VGK. However, this is more speculation until TLT confirms. Nonetheless, putting TLT aside, VGK appears to be a good investment going forward, with risk well defined at the recent lows where one could place a stop.

Further thoughts on including VGK in your portfolio

A US investor with assets primarily in US dollars must be aware of currency risk in every foreign investment. Buying a foreign asset is necessarily taking a position on the future of that foreign asset's home currency, so some hedging may be necessary based upon the value of the US dollar. I outline this issue in the "hedging out currency risk" portion of this article.

Further, correlation analysis is huge for constructing portfolios that are truly diversified. I use stockcharts.com's correlation coefficient to do my own analysis. The calculation is explained here. In short, assets with a correlation higher than 0 move in the same direction and those with a negative correlation move in opposite directions.

For diversification purposes, I have determined that assets with a historical correlation of higher than .75 are practically the same. I have made a graph of the correlation values of different ETFs to VTI, the total US stock market. As you can see, VTI has a correlation of 1, which means it moves exactly the same as itself.

You may be surprised to notice how similar VTI is to small caps (IWM), Developed Markets Ex-US (EFA), England (EWU), and Europe (VGK). They all share a .75 correlation or higher.

Therefore, it is important to remember that investing in VGK today does not lower your risk very much over holding VTI alone. The two holdings primarily move in the same direction, so if VTI goes down, VGK is likely going down with it. That being said, the amount by which they move in the same direction also varies. So you may benefit during the periods when VGK outperforms VTI. Thus, investing in VGK only diversifies the risk present in your risk-on or equity component of your portfolio, it does not significantly contribute to lowering the risk of your entire portfolio.

You can see that TLT with its coefficient of of -.22 significantly does lower overall portfolio risk as it often moves in the opposite direction of VTI. This is mathematical proof for why so many recommend holding both bonds and stocks in a portfolio.

For my personal portfolio, I include only QQQ, IWM, and XLU for my developed market exposure. As such, I lump together developed markets under the performance of the United States while avoiding currency risk. From the viewpoint of correlation, Japan, Europe, and the US are similar investments, except for the US is priced in US dollars and, thus, matches my major asset currency. My foreign holdings are only those which are more different from the US and include, China (FXI), India (EPI), and Brazil (EWZ). As you can see from the graph above, these holdings score a .55 or lower in correlation to the US. Here I am willing to forgo the currency risk in order to capture the significantly different performance capabilities of these emerging market investments.

In conclusion, I leave you with the following performance chart of various assets over the last 150 days. Can you see how powerful correlation is here? Look at the dark blue and cyan lines, VGK and EFA, compared to VTI, the red line, and Japan, the black line. Notice where each line dips and peaks. See the similarities? While end returns are different, notice how the directional similarity of each move means diversifying among this group does not protect you from any weakness in equities as an asset class. Compare to the teal line, TLT, and pink line XLU, with their lower correlation, which move differently.

Wednesday, March 4, 2015

NEW PAGE: US ECONOMIC HEALTH

I have published a new page for the blog which tracks US economic data from the FRED:

http://maintrimmercapital.blogspot.com/p/us-economic-health.html

The page features four new charts, the BIG 4, RISK 4, the MASTERPHASE INDEX, and an analysis of US YIELDS. Click the link above to learn more! This page will be another way the blog tracks the financial markets and US activity in particular.

Excerpts from the page:

"the data is useful for catching economic slowdowns before they are dominating all the headlines. For instance, you would have been tipped off that the economy was entering a recession by December 2007 from data from October 2007, before the stock market began its major sell off over 2008."

Learn about the Masterphase Index which tracks the health of the US economy.

http://maintrimmercapital.blogspot.com/p/us-economic-health.html

The page features four new charts, the BIG 4, RISK 4, the MASTERPHASE INDEX, and an analysis of US YIELDS. Click the link above to learn more! This page will be another way the blog tracks the financial markets and US activity in particular.

Excerpts from the page:

"the data is useful for catching economic slowdowns before they are dominating all the headlines. For instance, you would have been tipped off that the economy was entering a recession by December 2007 from data from October 2007, before the stock market began its major sell off over 2008."

Learn about the Masterphase Index which tracks the health of the US economy.

Sunday, February 15, 2015

The Last Time this Happened...

For those of us who appreciate technical analysis, I have a chart this week that I find very interesting in its potential implications:

1) There was much greater risk of a reversal in bond prices for the next few months as prices tended to reverse at the highs of the channel.

2) The S&P 500 began to outperform long term bonds in the next months

3) The S&P 500 also rallied strongly in the months following

4) Two instances were at the bottom of bear market declines in the S&P 500 (2002 & 2009)

5) Two instances were after pullbacks in the S&P 500 during a longer term bull market (1998 & 2012)

So, here we are at another potential turn around in bond prices. The upper channel challenge has yet to decisively complete as bond prices are still elevated versus the trend. However, noting the historical precedent, the risk is high that bond prices do not have further to rise from here.

Coincidentally, we are also seeing breakouts in many global markets coinciding with this moment in bond prices.

From the five observations above, it makes one wonder whether we are about to see a strong bull run in stocks. The common assumption is that money from bonds flows into stocks, so with bond notes selling, stocks may get a boost.

Moreover, with central banks aggressively providing liquidity and bonds on the brink of becoming disfavored, once the upper trend challenge completes, stocks are the likely recipient of future buying.

Now, bonds may not continue to respect the past 20 years of price history and perform differently at this juncture than in the past. Moreover, stocks may outperform bonds, but also sell off. However, looking at historical precedent, I'd say the odds are in favor of the future rhyming with the past. If so, better buckle your seat belt for the bulls about to pump the gas...

Monday, February 2, 2015

Weekly Short Course: 1/26-2/1

Sorry for posting a day late. I update my market models weekly and monitor the trends in their allocation numbers. While I do not follow every market, I follow many important markets via their representative ETFs. There is a list of the current ETFs I am tracking in the sidebar.

Here is a run through of this weeks observations:

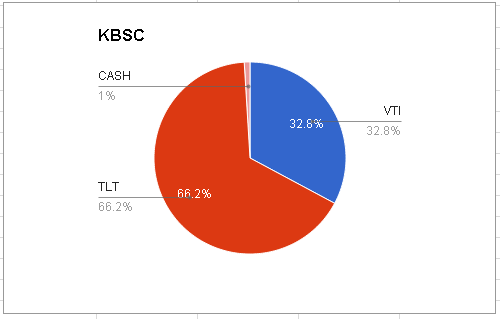

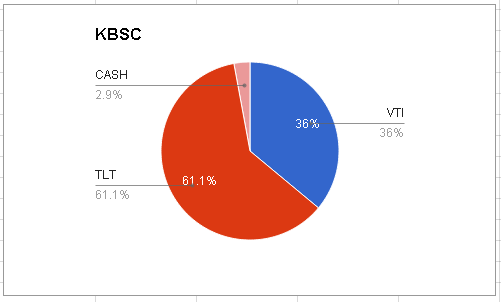

One of my models is a simple allocation program between the total stock market, VTI, and long term government bonds, TLT. These two ETFs are a great pair to follow since they have almost the same average volatility. Thus, they can be compared based on pure relative strength with about equal expectations for each holdings appreciation or depreciation capability.

The current allocation for this program is Conservative (<40% stocks). This week saw a slight shift back towards bonds.

January was a weak month for US stocks. Traders are abuzz whether we will repeat a 2014 type performance or see more downside. With the number of defensive signs in the market and the technical differences between now and 2014, I am much more concerned about downside risk in US stocks this year. Buyers and sellers are much more in a dead heat this time around as longer term trends go flat.

Here is a run through of this weeks observations:

The Basic Model

One of my models is a simple allocation program between the total stock market, VTI, and long term government bonds, TLT. These two ETFs are a great pair to follow since they have almost the same average volatility. Thus, they can be compared based on pure relative strength with about equal expectations for each holdings appreciation or depreciation capability.

The current allocation for this program is Conservative (<40% stocks). This week saw a slight shift back towards bonds.

January was a weak month for US stocks. Traders are abuzz whether we will repeat a 2014 type performance or see more downside. With the number of defensive signs in the market and the technical differences between now and 2014, I am much more concerned about downside risk in US stocks this year. Buyers and sellers are much more in a dead heat this time around as longer term trends go flat.

Checking in on Five Horsemen of US Stock Risk for January

Mentioned a few weeks ago, I spoke on the ETFs I felt represented fear in the global markets, particularly as pertains to the US stock market. As you can see above, all five performed very well in January, reflecting widespread defensiveness to start the year. This is not conclusive evidence for a coming correction or bear market. It is merely an observation highlighting the heightened risk in US stocks currently.

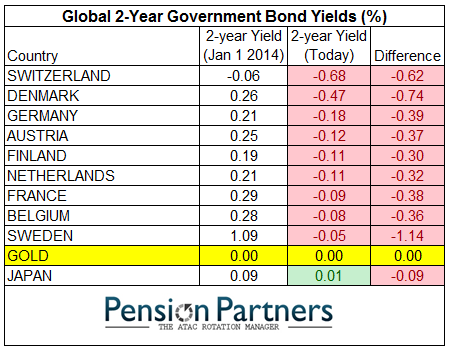

Gold, a Zero Yield Investment?

I borrowed the chart below from Pension Partners to show something I am thinking about concerning the recent strength in gold. Gold is a traditionally inflationary asset, being a store of value when national currencies depreciate over time. However, gold has been strong to start the year in the face of both a strong dollar and a highly deflationary environment.

The strength could be caused by a shear fear trade as the other tail wind to inflation for gold is panic buying. However, many articles are coming out offering another fundamental reason why gold could find strength in an extreme deflationary environment. When bond yields go negative and are expected to continue to drop in the current environment gold can become competitive as an alternative investment to the safety of bonds. Yield is the classic advantage of investing in bonds over gold. Does gold catch a bid when this advantage is practically removed by negative interest rates?

Overall

Deflationary assets (bonds, dollar, inverse commodites, gold, defensive stock sectors) continue to lead and black clouds remain over the US stock market. I am still waiting for signs of a real fight in global stocks for the year. Will it come in February?

See you all next week!

See you all next week!

Sunday, January 25, 2015

Weekly Short Course: 1/19-1/25

I update my market models weekly and monitor the trends in their allocation numbers. While I do not follow every market, I follow many important markets via their representative ETFs. There is a list of the current ETFs I am tracking in the sidebar.

Here is a run through of this weeks observations:

One of my models is a simple allocation program between the total stock market, VTI, and long term government bonds, TLT. These two ETFs are a great pair to follow since they have almost the same average volatility. Thus, they can be compared based on pure relative strength with about equal expectations for each holdings appreciation or depreciation capability.

The current allocation for this program is Conservative (<40% stocks). This week saw a slight shift back towards stocks and a reduction of cash.

It remains to be seen what is in store for US equities in the first half of 2015. We are finally making it back to positive territory for the year, but the risks are still high. It will take more time for markets to digest European QE. Looking at the data, I cannot draw any other conclusion than my holdings are in traditionally defensive areas of the market. Does this mean we are heading for meaningful weakingness in global equities? Remains to be seen. The markets are always churning, and sometimes holdings in uptrends just need a rest.

We need more time for US equities to tip their hand. Meanwhile, there are plenty of other places to have capital that are not in such ambiguous positions.

Here is a run through of this weeks observations:

The Basic Model

One of my models is a simple allocation program between the total stock market, VTI, and long term government bonds, TLT. These two ETFs are a great pair to follow since they have almost the same average volatility. Thus, they can be compared based on pure relative strength with about equal expectations for each holdings appreciation or depreciation capability.

The current allocation for this program is Conservative (<40% stocks). This week saw a slight shift back towards stocks and a reduction of cash.

It remains to be seen what is in store for US equities in the first half of 2015. We are finally making it back to positive territory for the year, but the risks are still high. It will take more time for markets to digest European QE. Looking at the data, I cannot draw any other conclusion than my holdings are in traditionally defensive areas of the market. Does this mean we are heading for meaningful weakingness in global equities? Remains to be seen. The markets are always churning, and sometimes holdings in uptrends just need a rest.

We need more time for US equities to tip their hand. Meanwhile, there are plenty of other places to have capital that are not in such ambiguous positions.

Keep an Eye on Emerging Markets

Above is a weekly chart of EEM, an ETF that comprises equities from emerging market economies like China, India, Brazil, Taiwan, and South Korea. As you can see, when EEM has broken out on a weekly basis in the past, EEM has tended to be strong for many weeks afterwards. We are in the midst of another break out. It will be a good idea to keep EEM and other ETFs like FXI (China), EPI (India), Brazil (EWZ), etc on your shopping lists as they may continue to perform well in the coming weeks.

Hedging Out Currency Risk

Interested in investing in Europe now that QE is confirmed? Be careful which funds you buy! As a US investor with assets, and, thus, capital, priced in US dollars, you cannot simply purchase foreign assets thinking they will move in the same manner as US stocks. Because foreign assets are priced in their home currencies, their value to a US investor is not only what price they will fetch on the foreign market, but also how their respective currency is changing relative to the US dollar.

Look at the charts below which show EWG, the Germany Fund, and DXGE, the Germany Currency-Hedged Equity Fund for the SAME time period. There is a substantial difference in price appreciation for both holdings:

As the Euro weakens towards the dollar, this makes all assets priced in Euros worth "less" to American investors dealing in US dollars. Both EWG and DXGE have exposure to the German stock market, but only DXGE outperforms when the Euro is weak and EWG outperforms when the Euro is strong.

It is good to do your homework on the financial instruments available and tailor your portfolio to current conditions. Wisdomtree, for instance, has a a lineup of currency-hedged funds, including DXGE (Germany), DXJ (Japan), and HEDJ (Total International). DBEU is a Europe hedged fund if you are looking for a VGK alternative.

Overall

Deflationary assets (bonds, dollar, inverse commodites, gold, defensive stock sectors) continue to lead and black clouds remain over the US stock market. Eurozone easing may be providing a ray of light, however.

Emerging markets may be experiencing a short-term breakout. Check out gold too (not mentioned above)!

See you all next week!

Emerging markets may be experiencing a short-term breakout. Check out gold too (not mentioned above)!

See you all next week!

Monday, January 19, 2015

Weekly Short Course: 1/12-1/18

I update my market models weekly and monitor the trends in their allocation numbers. While I do not follow every market, I follow many important markets via their representative ETFs. There is a list of the current ETFs I am tracking in the sidebar.

Here is a run through of this weeks observations:

One of my models is a simple allocation program between the total stock market, VTI, and long term government bonds, TLT. These two ETFs are a great pair to follow since they have almost the same average volatility. Thus, they can be compared based on pure relative strength with about equal expectations for each holdings appreciation or depreciation capability.

The current allocation for this program IS NOW Conservative (about <40% stocks). This week saw another shift towards bonds with the stagnation in stocks.

Last week, I said I would be worried about US stocks if my models started to raise cash against US holdings. As you can see, the basic model has begun to do just that. However, this is a basic model for a reason. I trust it in the long term to allocate correctly. Thus, I would like to see a week or two more sustained at these allocations to assume a more bearish outlook for US stocks.

A potential bullish outcome of these numbers is that the October 2014 low also coincided with these sorts of allocations before stocks rallied into the year's end. Thus, it may be time for US stocks to flex some relative strength (not necessarily absolute strength) muscle this coming week. Regardless, US stocks have been weak relative to other assets the past few weeks.

See you all next week!

Here is a run through of this weeks observations:

The Basic Model

One of my models is a simple allocation program between the total stock market, VTI, and long term government bonds, TLT. These two ETFs are a great pair to follow since they have almost the same average volatility. Thus, they can be compared based on pure relative strength with about equal expectations for each holdings appreciation or depreciation capability.

The current allocation for this program IS NOW Conservative (about <40% stocks). This week saw another shift towards bonds with the stagnation in stocks.

Last week, I said I would be worried about US stocks if my models started to raise cash against US holdings. As you can see, the basic model has begun to do just that. However, this is a basic model for a reason. I trust it in the long term to allocate correctly. Thus, I would like to see a week or two more sustained at these allocations to assume a more bearish outlook for US stocks.

A potential bullish outcome of these numbers is that the October 2014 low also coincided with these sorts of allocations before stocks rallied into the year's end. Thus, it may be time for US stocks to flex some relative strength (not necessarily absolute strength) muscle this coming week. Regardless, US stocks have been weak relative to other assets the past few weeks.

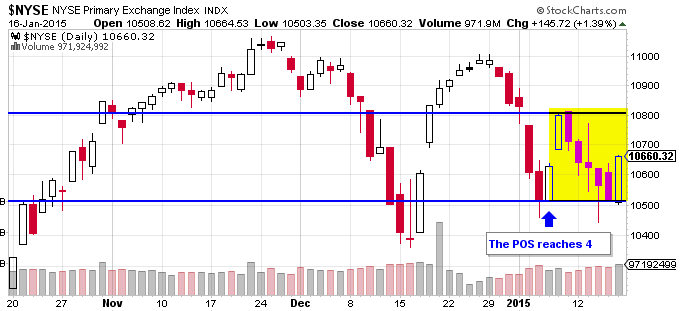

What's up with the POS? Is it stuck?

If you have been following my POS market index, you have noticed that it has stayed at 4, caution, for almost two weeks.

I have looked into this and there is actually good reason why my model has not gone full bearish where others like Dr. Wish have their GMIs on a sell. Take a look at the $NYSE for the time the POS has been at a 4:

During the last few days, the stock market has gone sideways, stuck in a horizontal channel. While this is not ideal, it is certainly not a reason to panic. Moreover, the S&P 500 has not pulled back more than 5% from its recent high during the current weakness. Remember, 10% is the marker for a correction.

Thus, the POS is actually doing exactly as I hoped. Let's visit my explanation of the POS scores (under POS Scores Explained) for a "4": 3-4 & Down-tick: Caution, markets are indecisive, do not open any new longs, tighten stops and look to exit. This is exactly what I would want in the back of my mind for current conditions. Do not look to go long, and tighten stops, but don't run for the hills yet, until further weakness occurs.

Stocks could launch from here to new highs. They could also drop, but if you are working with proper risk management, sometimes it pays a lot more to stay in, at least partially, during sideways moves. For instance, my experimental trading strategy for the POS has 1/2 a position on the current market. It has taken money off the table sure, but it will benefit if stocks resume an uptrend from here as the position is anchored back into December 22, when the POS revved up to a 7.

Discipline: Strap Me to the Mast!

Any good trading or investing strategy is designed to give us an advantage. That's why strategies exist. They are rules to make us a profit in the long run. The problem, however, is our psychology is not good at following long term strategies. We crave the short term payoffs and despise any short term pain. The problem comes when we abandon good strategy to appease our emotions. It is at that moment when we throw our well-designed and thought-through advantage to the wind and expose ourselves to the perils of pure gambling and sentiment.

Strategies that catch the high flyers are particularly prone to human weakness as something that is making new highs inevitably will correct or reverse trend eventually. For instance, there are a lot of holdings heading to the moon like Long Term bonds, the US dollar, and inverse commodities. The more weeks that these holdings march forward, the more weary our minds get of the coming pullback. We know it cannot last forever.

I have seen many technical articles about the coming reversal in US bonds or the dollar, for example, and I can't help but agree with their arguments. However, if I were to abandon my strategy before this inevitable weakness showed up, I'd be throwing away the very system that allowed me to profit from them in the first place. I can't both profit from these trends and also completely avoid the first stages of those trend reversals (under my principles). Thus, no matter what I have to stay committed to the rules. The rules may allow for short term weakness, but they are designed for long term gain. And, as good as short term gain FEELS, long term gain is all that matters in the end.

It can be tough, but as long as your system is designed to be self-correcting or risk managing, it will carry you through the rough patches. Don't give up. Your greatest financial enemy is often yourself.....and most definitely the financial media.... Also, make sure your strategy rests on sound principles, it could just be bad....

Overall

Deflationary assets (bonds, dollar, inverse commodites, defensive stock sectors) continue to lead and black clouds remain over the US stock market. However, there has been much buzz over EU QE this week, which may coincide with a shift to a new set of leaders as 2015 continues. It will be interesting to watch. Also, have you seen the big moves in both the Swiss (franc) and Chinese ($SSEC) markets due to big surprises this last week? A lot of money is moving in these shocks.

For the coming weeks, I will navigate whatever comes even if I have to strap myself to the mast. Can you say that for your strategy?

For the coming weeks, I will navigate whatever comes even if I have to strap myself to the mast. Can you say that for your strategy?

Sunday, January 11, 2015

Weekly Short Course: 1/5-1/9

I update my market models weekly and monitor the trends in their allocation numbers. While I do not follow every market, I follow many important markets via their representative ETFs. There is a list of the current ETFs I am tracking in the sidebar.

Here is a run through of this weeks observations:

One of my models is a simple allocation program between the total stock market, VTI, and long term government bonds, TLT. These two ETFs are a great pair to follow since they have almost the same average volatility. Thus, they can be compared based on pure relative strength with about equal expectations for each holdings appreciation or depreciation capability.

The current allocation for this program is Balanced (about 1:1 stocks:bonds). This week saw another shift towards bonds with the stagnation in stocks.

As a technical analyst, I am as much a bull or a bear as the market allows at anyone time. Any reasons I could appeal to beyond observations of changes in price are speculation and almost worthless in my book. Thus, with many major indexes near all-time highs, I am more a bull than a bear on US stocks. Also, anytime weakness occurs in the course of a trend, it is probabilistically just a temporary pullback and not a trend change. The markets do trend- they get as many pullbacks as maintains the overall trend and only one trend change in in each trend's lifespan. Thus, you are playing a low-odds of success Russian roulette at best and are fearmongering at worst to call a top at any one pullback (I am looking at you financial media!).

There are a few ETFs I track that are negatively correlated with stock market at times of high stress in the global markets, the five horseman of the US stock apocalypse, so to speak. The five are Long Term Government Bonds (TLT), the US dollar (UUP), the Japenese Yen (FXY), Gold (GLD), and Short-term VIX futures (VXX).

There are fundamental reasons why each of these holdings tends to do well in times of stock stress, although I prefer the simpler observations of the their price performance during times of stress to explain their inclusion in the list. Look at their progress during the 2008 recession, for instance. Nonetheless, I will speculate on fundamental reasons why these are defensive assets, if it is helpful for your own interests. In short: TLT is seen as a conservative investment in the safety of the US government; UUP tends to outperform in the depths of fear as investors go to cash fast, specifically the world-reserve currency, the US dollar as demand for commodities plummet; FXY tends to outperform when Japanese investors, some of the most conservative in the world, ditch stocks and risky assets as well; GLD is seen as a store of value in the face of both inflation and loss of attractiveness of traditionally risky assets; and finally VXX tracks the VIX, an index tracking investor usage of options to buy either upwards or downwards protection for their holdings. The VIX increases when investors buy more puts (downside protection) so positivity in VXX means investors are buying more insurance against potential future losses.

With this background in mind, below is the chart that shows some small concern. In the last three weeks, the NYSE has failed to make new highs (red lines), while the five horseman all show short term positivity (green lines):

Now, there are obviously other reasons why some of these holdings are performing as they are other than solely due to investor risk aversion. TLT and UUP, for instance, are in long term uptrends already. However, if the positivity in at least four of these areas continues, it may mean new lows for stocks due to the historical correlations that exist in the pricing of these different holdings.

That being said, the bullish outcome for US stocks is that the short term postivity in FXY, GLD, and VXX are just more countertrend rallies that have occured before. If these ETFs breakdown lower, stocks are headed higher, breaking out yet again from a countertrend rally of their own. At the least, it will be interesting to watch in the coming weeks.

Finally, neither the US stock market nor the five horseman "cause" performance in each other. So, it is wrong to see strength in any one asset class as causing another asset class to do such and such. Rather, it is more correct to say that they move together in a specific manner (this is the basic meaning of correlation).

I personally will not be too "concerned" about US stocks until my models start raising cash against my US stock holdings, or US stocks otherwise become unusually small positions amongst my overall holdings. Has not happened yet.

On a "sunnier" note, last week was excellent for TLT, short oil, short euro, and long China. What is good or bad is all about perspective and what positions you hold. My holdings have continued to gain with the negativity in US stocks to start the year.

The POS is on a 4, a cautionary zone that means prices are currently treading water and will resolve in one direction or another soon.

Keep an eye on the Nasdaq too, this classic growth index has not been doing so hot the last few weeks. It failed to make a new high with the other indexes at the end of December. A sick Nasdaq is another black cloud over the market right now.

Speculating, like gambling, is fun! My observations above, so far as they could be construed to be predicting future downside in the stock market, is speculation. However, I do not trade on speculation and neither should you. Stay in step with the market and you will be rewarded in the long-term. This, in my opinion, is the true reason why Warren Buffet does not believe you can time the market. Timing, done incorrectly, leads too many to try and predict rather than follow trend changes. As I mentioned above, trend changes are very rare compared to temporary pullbacks.

See you next week!

Here is a run through of this weeks observations:

The Basic Model

One of my models is a simple allocation program between the total stock market, VTI, and long term government bonds, TLT. These two ETFs are a great pair to follow since they have almost the same average volatility. Thus, they can be compared based on pure relative strength with about equal expectations for each holdings appreciation or depreciation capability.

The current allocation for this program is Balanced (about 1:1 stocks:bonds). This week saw another shift towards bonds with the stagnation in stocks.

Storm Clouds on the Horizon?

There are a few ETFs I track that are negatively correlated with stock market at times of high stress in the global markets, the five horseman of the US stock apocalypse, so to speak. The five are Long Term Government Bonds (TLT), the US dollar (UUP), the Japenese Yen (FXY), Gold (GLD), and Short-term VIX futures (VXX).

There are fundamental reasons why each of these holdings tends to do well in times of stock stress, although I prefer the simpler observations of the their price performance during times of stress to explain their inclusion in the list. Look at their progress during the 2008 recession, for instance. Nonetheless, I will speculate on fundamental reasons why these are defensive assets, if it is helpful for your own interests. In short: TLT is seen as a conservative investment in the safety of the US government; UUP tends to outperform in the depths of fear as investors go to cash fast, specifically the world-reserve currency, the US dollar as demand for commodities plummet; FXY tends to outperform when Japanese investors, some of the most conservative in the world, ditch stocks and risky assets as well; GLD is seen as a store of value in the face of both inflation and loss of attractiveness of traditionally risky assets; and finally VXX tracks the VIX, an index tracking investor usage of options to buy either upwards or downwards protection for their holdings. The VIX increases when investors buy more puts (downside protection) so positivity in VXX means investors are buying more insurance against potential future losses.

With this background in mind, below is the chart that shows some small concern. In the last three weeks, the NYSE has failed to make new highs (red lines), while the five horseman all show short term positivity (green lines):

Now, there are obviously other reasons why some of these holdings are performing as they are other than solely due to investor risk aversion. TLT and UUP, for instance, are in long term uptrends already. However, if the positivity in at least four of these areas continues, it may mean new lows for stocks due to the historical correlations that exist in the pricing of these different holdings.

That being said, the bullish outcome for US stocks is that the short term postivity in FXY, GLD, and VXX are just more countertrend rallies that have occured before. If these ETFs breakdown lower, stocks are headed higher, breaking out yet again from a countertrend rally of their own. At the least, it will be interesting to watch in the coming weeks.

Finally, neither the US stock market nor the five horseman "cause" performance in each other. So, it is wrong to see strength in any one asset class as causing another asset class to do such and such. Rather, it is more correct to say that they move together in a specific manner (this is the basic meaning of correlation).

Overall

I personally will not be too "concerned" about US stocks until my models start raising cash against my US stock holdings, or US stocks otherwise become unusually small positions amongst my overall holdings. Has not happened yet.

On a "sunnier" note, last week was excellent for TLT, short oil, short euro, and long China. What is good or bad is all about perspective and what positions you hold. My holdings have continued to gain with the negativity in US stocks to start the year.

The POS is on a 4, a cautionary zone that means prices are currently treading water and will resolve in one direction or another soon.

Last Words

Keep an eye on the Nasdaq too, this classic growth index has not been doing so hot the last few weeks. It failed to make a new high with the other indexes at the end of December. A sick Nasdaq is another black cloud over the market right now.

Speculating, like gambling, is fun! My observations above, so far as they could be construed to be predicting future downside in the stock market, is speculation. However, I do not trade on speculation and neither should you. Stay in step with the market and you will be rewarded in the long-term. This, in my opinion, is the true reason why Warren Buffet does not believe you can time the market. Timing, done incorrectly, leads too many to try and predict rather than follow trend changes. As I mentioned above, trend changes are very rare compared to temporary pullbacks.

See you next week!

Sunday, January 4, 2015

Weekly Short Course 12/29-1/2

I update my market models weekly and monitor the trends in their allocation numbers. While I do not follow every market, I follow many important markets via their representative ETFs. There is a list of the current ETFs I am tracking in the sidebar.

Here is a run through of this weeks observations. While I analyze the markets using measures of absolute momentum, I include performance charts here for a quick and dirty illustration of performance. Where I wish to specifically show momentum, I use MACD charts.

My basic model: One of my models is a simple allocation program between the total stock market, VTI, and long term government bonds, TLT. These two ETFs are a great pair to follow since they have almost the same average volatility. Thus, they can be compared based on pure relative strength with about equal expectations for each holdings appreciation or depreciation capability. I've decided to share my weekly numbers for this program since it is so simple:

The current allocation for this program is Balanced (about 1:1 stocks:bonds). This week saw a shift towards bonds.

Here is a run through of this weeks observations. While I analyze the markets using measures of absolute momentum, I include performance charts here for a quick and dirty illustration of performance. Where I wish to specifically show momentum, I use MACD charts.

My basic model: One of my models is a simple allocation program between the total stock market, VTI, and long term government bonds, TLT. These two ETFs are a great pair to follow since they have almost the same average volatility. Thus, they can be compared based on pure relative strength with about equal expectations for each holdings appreciation or depreciation capability. I've decided to share my weekly numbers for this program since it is so simple:

The current allocation for this program is Balanced (about 1:1 stocks:bonds). This week saw a shift towards bonds.

The Dollar is King- The US dollar continues its streak upwards into 2015. UUP is en ETF that represents the value of the US dollar versus other major currencies, especially the Euro and Yen. The chart below shows how other currencies' pain is the dollar's gain:

Overall- This week saw a step away from US stocks and into Treasuries, the Chinese stock market, and the Dollar.

The POS is on an 8, but any substantial weakness this week will turn it negative. The markets have stagnated to a decision point. We should know the next major direction by the end of the week.

See you next week!

Subscribe to:

Posts (Atom)